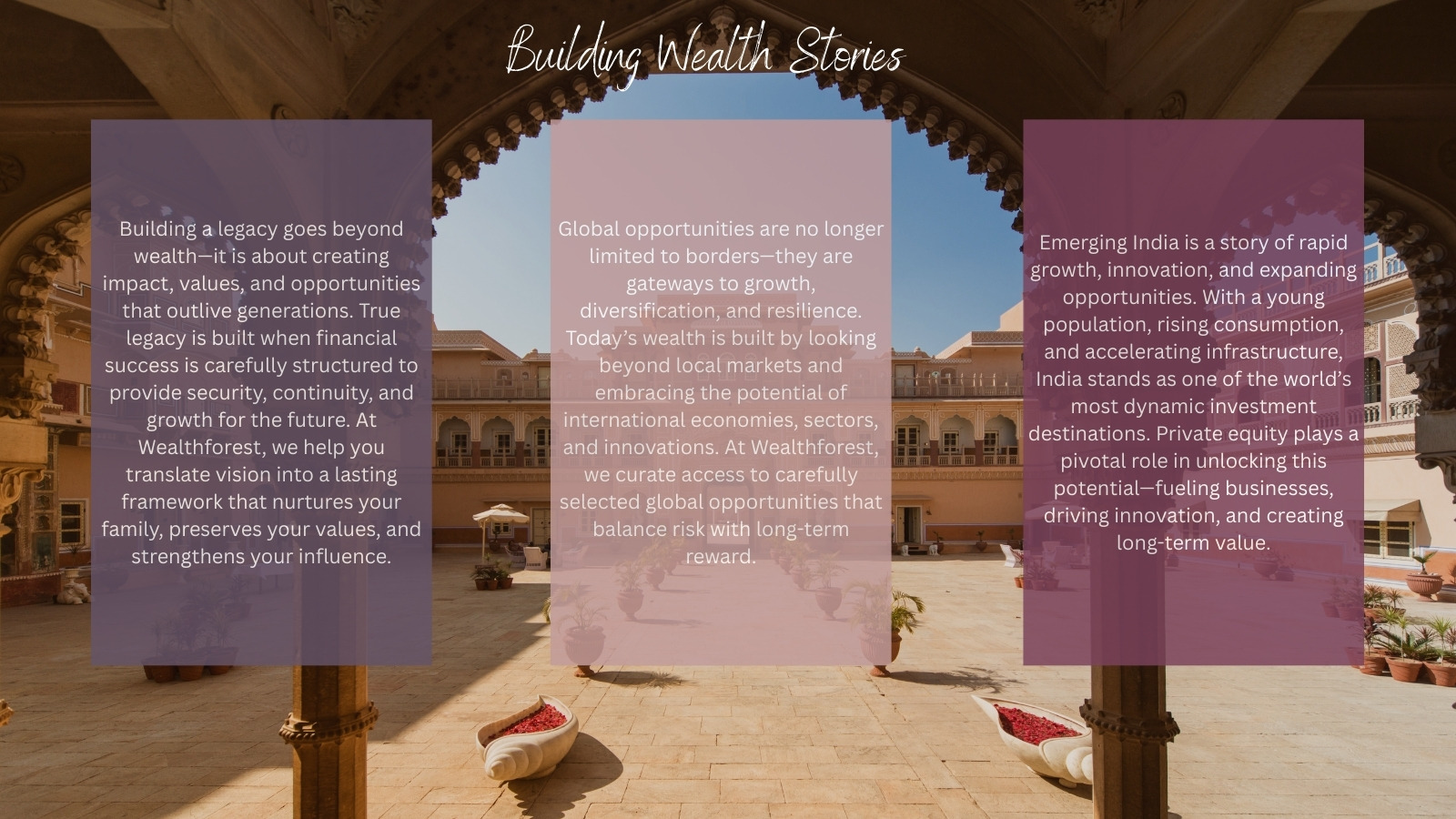

Benefit from our history of delivering consistent and exceptional investment outcomes for high-net-worth clients.

We invest alongside you, ensuring that our success is directly tied to yours.

Tailored investment strategies designed to match your financial goals, risk appetite, and market opportunities.

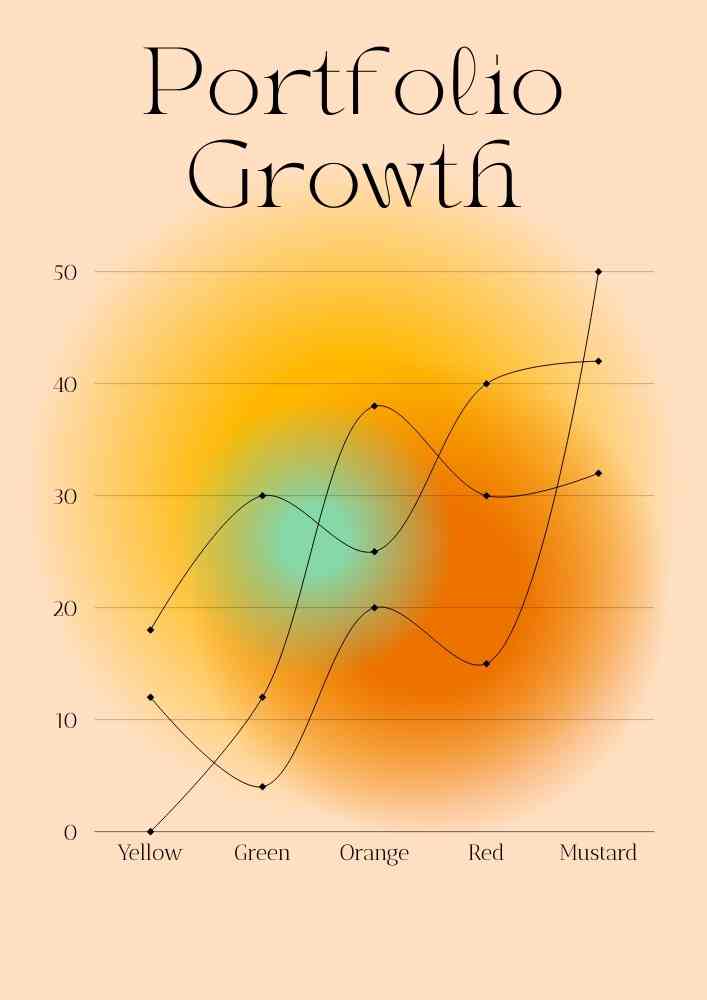

The true potential of compounding unfolds when investments are disciplined, consistent, and guided by exclusive wealth-building strategies. Our tailored plans are designed to protect your capital while creating significant long-term growth, turning even modest investments into substantial wealth over time.